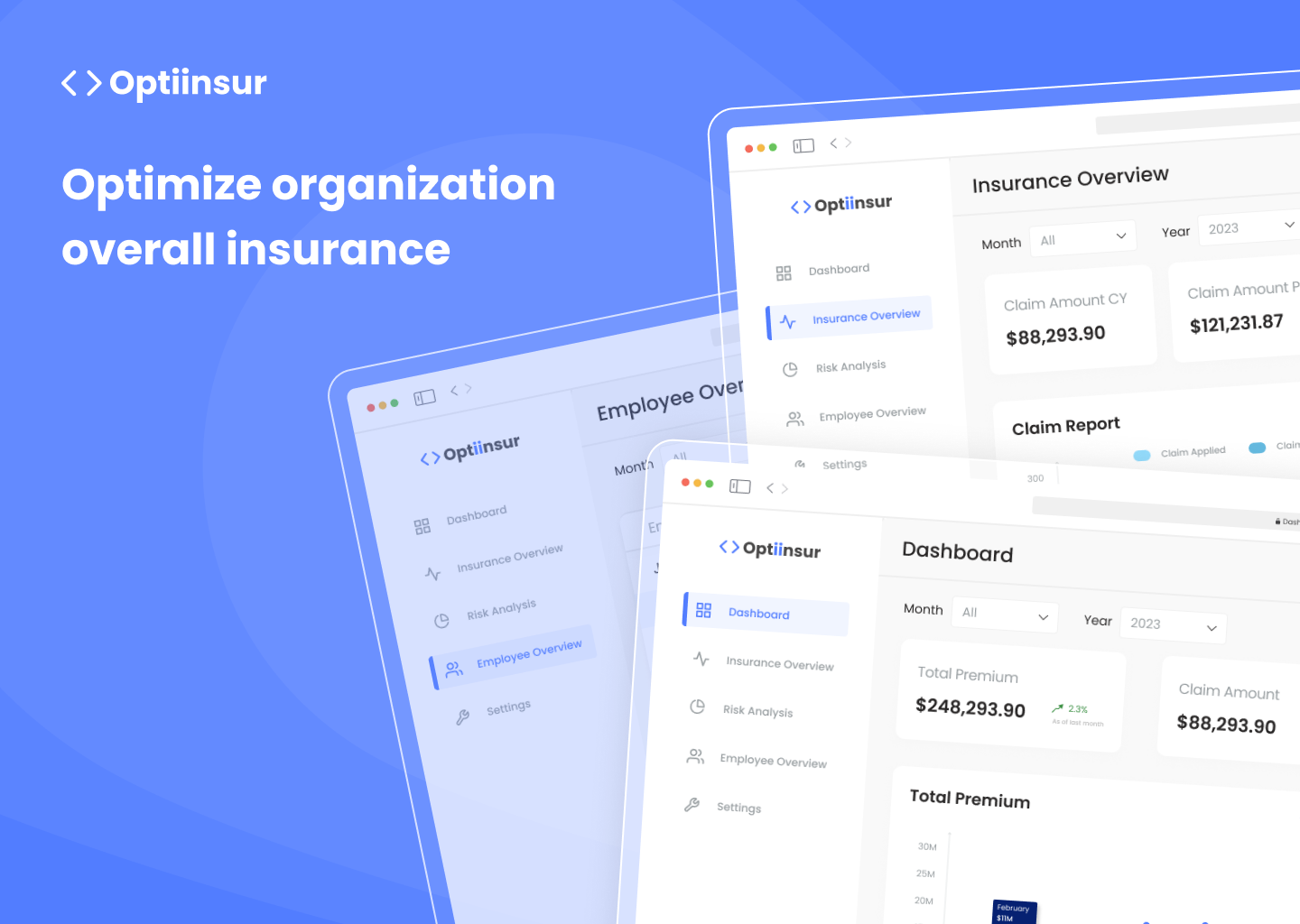

Opti-insur: Optimize organization overall insurance

Introduction:

As organizations strive to optimize their resources and provide comprehensive benefits to employees, understanding and managing company-wide insurance becomes increasingly crucial. This will focuses on designing a product that enables employers to review their insurance status, identify potential risks, and make informed decisions to save costs.

Problem Statement:

Employers lacks a insightful product to analyze employee medical history data and assess the overall status of company-wide insurance. Without actionable insights, they struggle to make informed decisions, leading to potential risks in overspending and cost-saving measures.

Goal:

To design a user-friendly product that helps the employers to:

1. Review the overall status of company-wide insurance.

2. Identify potential risks and cost-saving opportunities through

analysis of employee medical history data.

3. Make informed decisions to optimize insurance coverage and

control costs.

Design Process

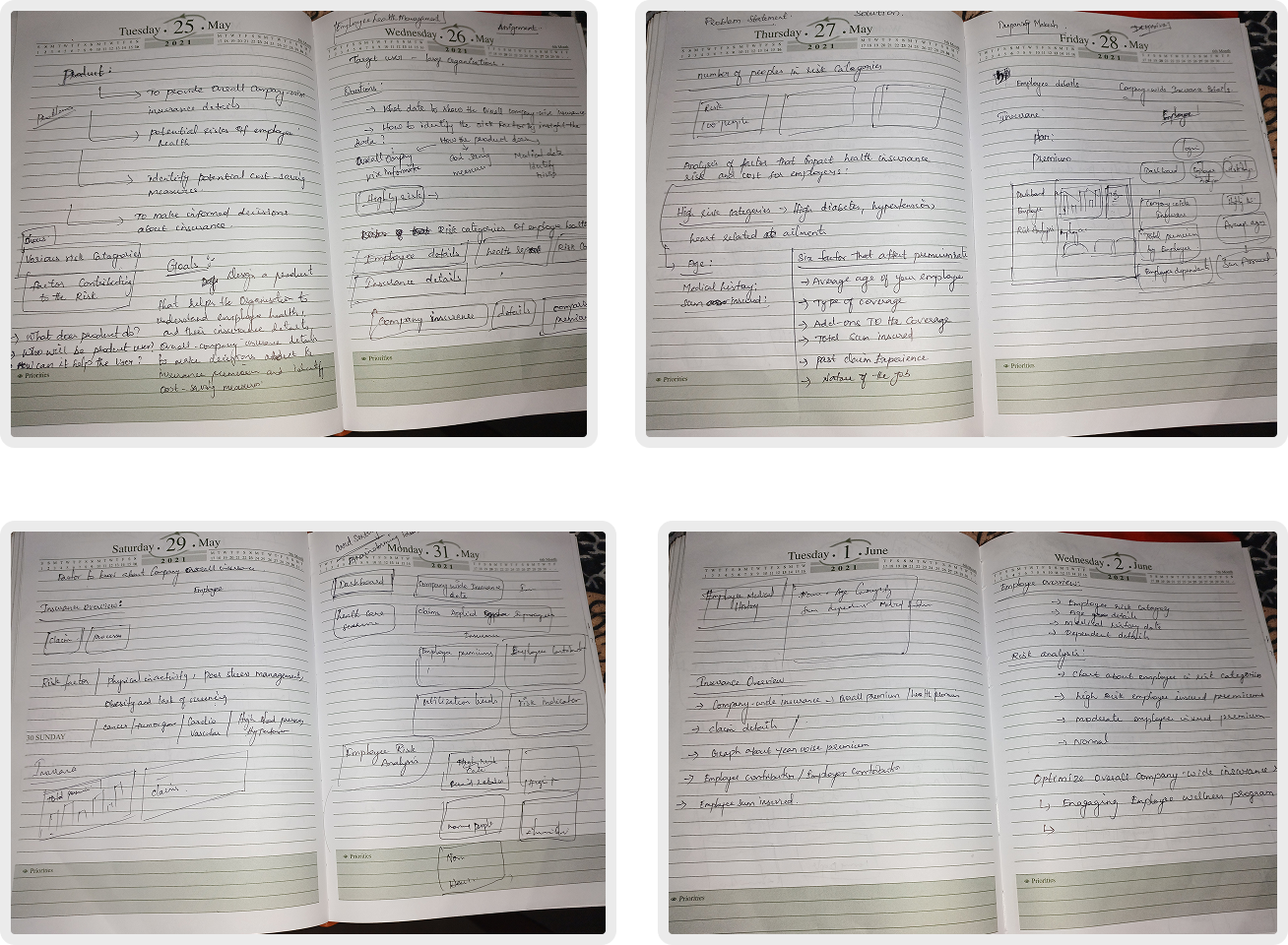

UX Research:

Did the secondary research to understand pain points and user needs. Analyzed how insurance management system works and what are the risk factors that directly or indirectly affect the organization overall insurance premium. How to mitigate the risks involved in insurance. Identify groups of employees with specific health conditions oro risk factors that contribute to higher insurance costs.

Factors that impact insurance rate

01

Age

The amount of insurance you choose will change how much you pay for health insurance. If you pick a lower insurance amount, you will pay less for your premium. But if you choose more insurance, your premium will be higher. So, its important to pick the right amount of insurance, you dont have to pay too much in an emergency.

02

Sum Insured

Did the secondary research to understand pain points and user needs. Analyzed how insurance management system works and what are the risk factors that directly or indirectly affect the organization overall insurance premium. How to mitigate the risks involved in insurance. Identify groups of employees with specific health conditions oro risk factors that contribute to higher insurance costs.

03

Medical History

When someone has long-lasting health problems like diabetes, high blood pressure, or asthma, they usually need more medical care and have bigger bills. So, they'll probably have to pay more for their insurance compared to someone who's healthy and the same age.How much more you pay depends on how serious your health problem is, as decided by a doctor.

04

Plan Chosen

The kind of health plan you pick affects how much you pay for insurance. For instance, a family plan usually costs less than one for just you because it's likely someone in the family will get sick. But with a family plan, keep in mind the cost goes up based on how old the oldest person in the family is.

05

Drugs Claim

Almost 20% of all medical expenses come from paying for prescription drugs. Companies with lots of employees who need regular medicine usually have to pay more for insurance.

Ideation:

Did a brainstorming to generate ideas and insights giving us a sense of where most people's thinking is focused. Used an diagram to gather opinions and issues together organized them into groupings.

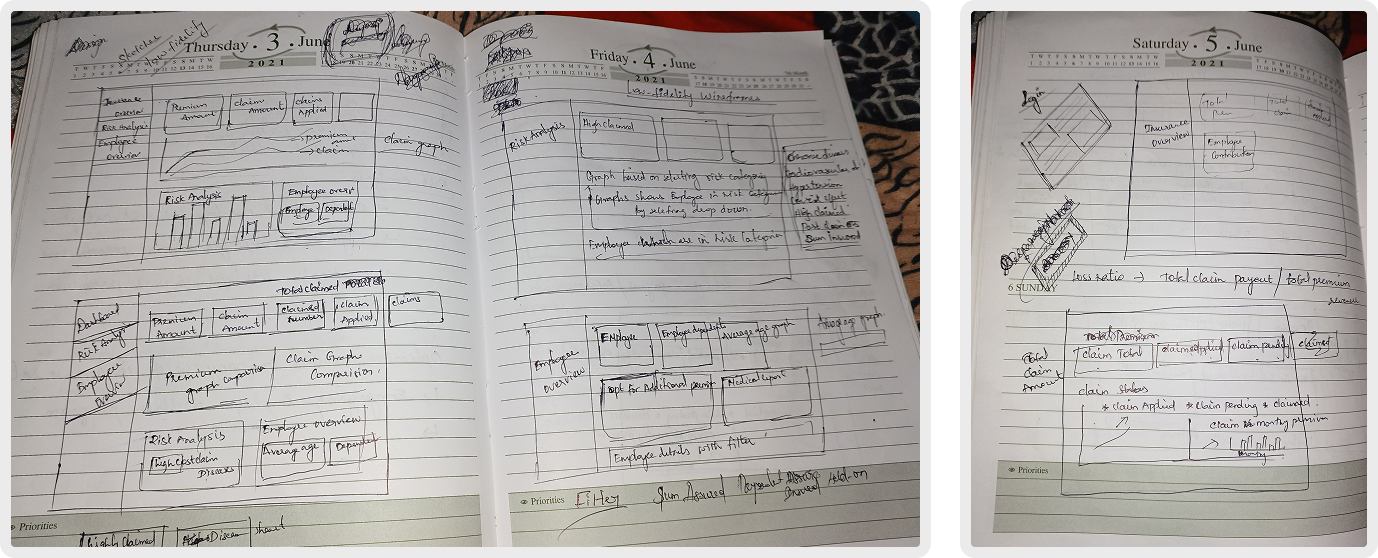

Wireframes:

Created wireframes for each section to outline the layout and functionality.

Visual Design:

-

Developed a clean and modern interface with a focus on data visualization.

-

Utilized color-coded charts and graphs to highlight key insights and trends.

-

Ensured accessibility and readability for users of all backgrounds.

Key Features

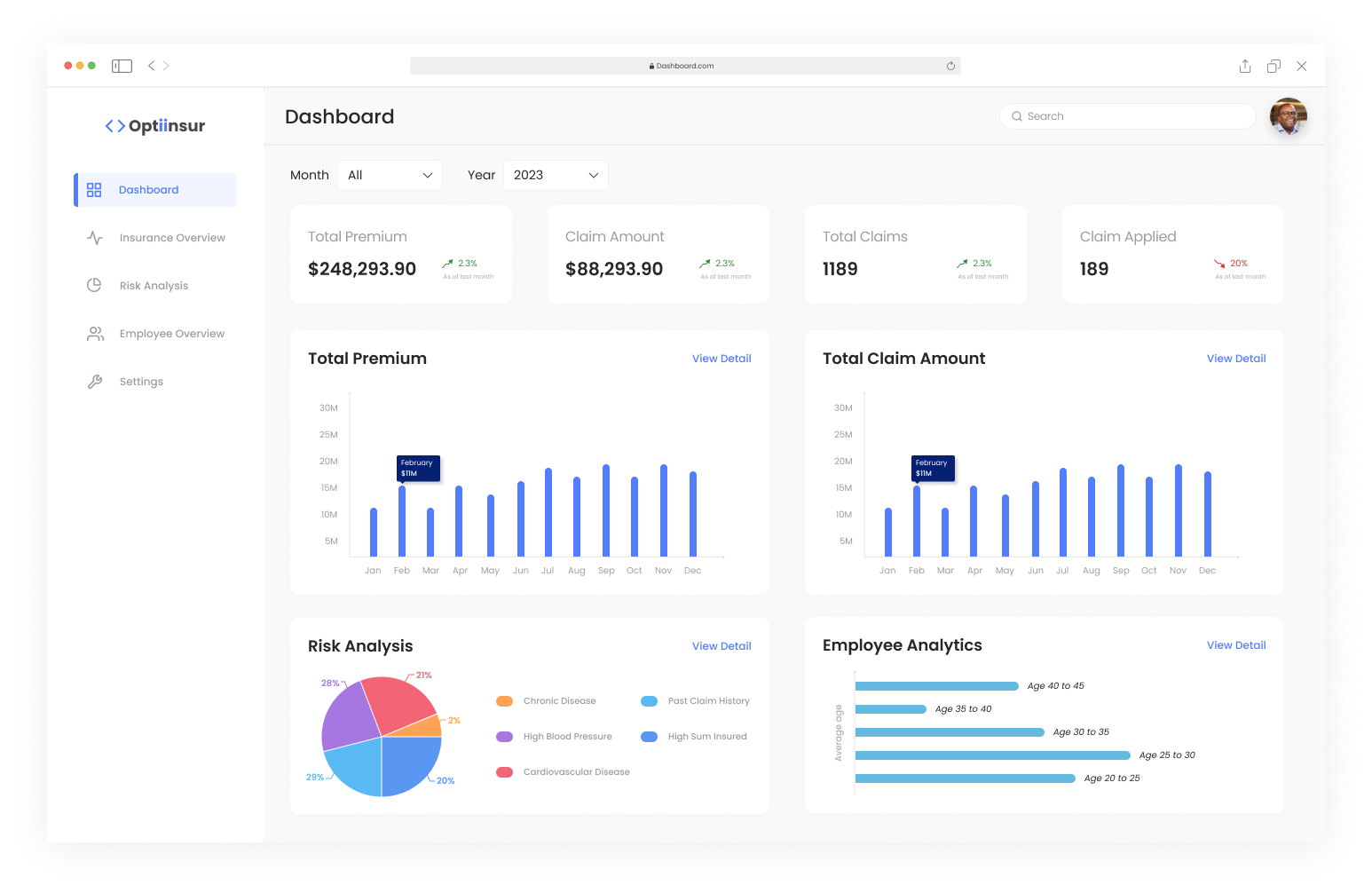

Dashboard:

Provides a high-level overview of insurance status, including premium costs, total claim details, risk indicators and employee analytics. This dashboard helps to understand the organization overall insurance rates with actionable data insights.

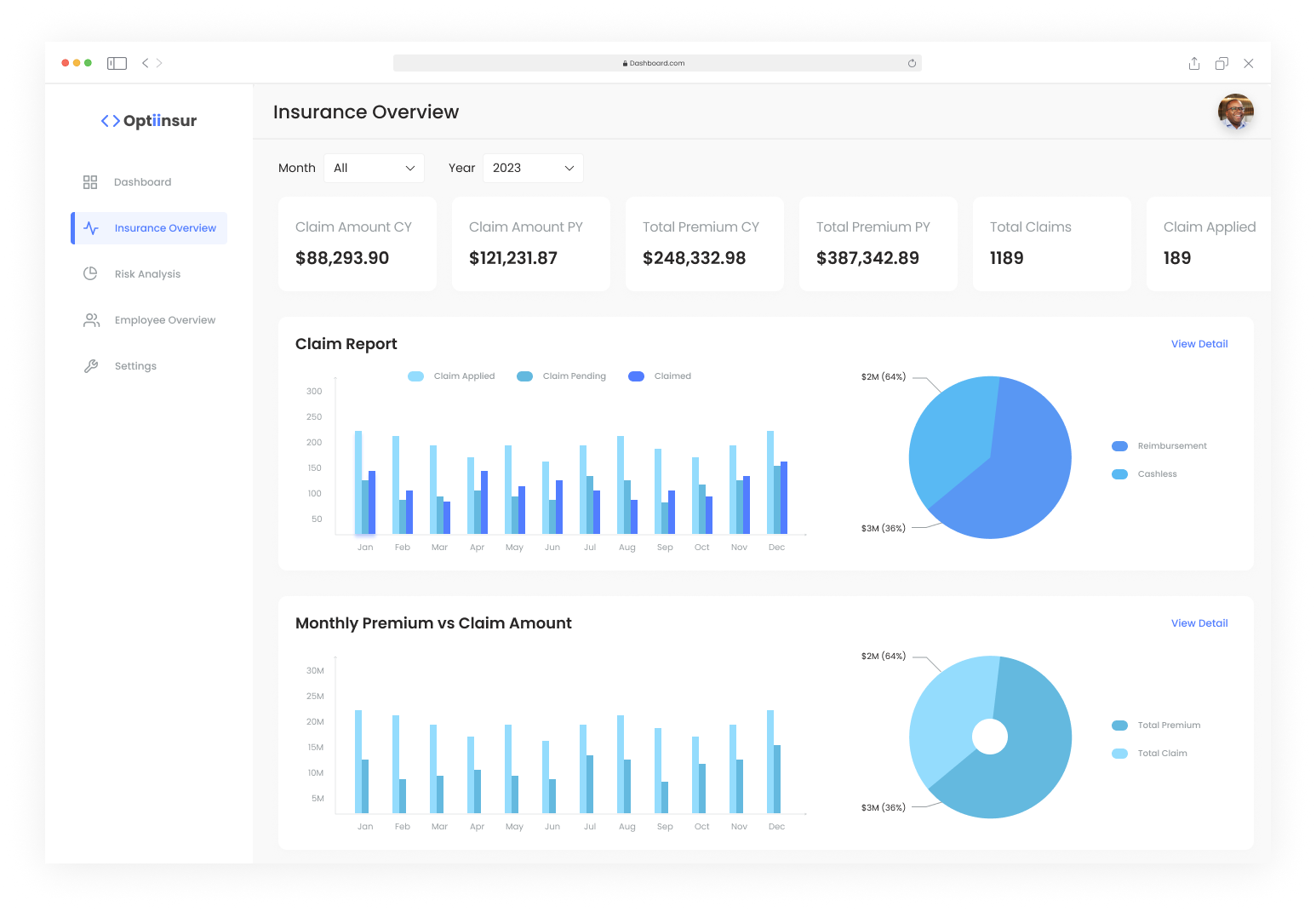

Insurance Overview:

Detailed breakdown of insurance overview consists total premiums with current and previous year, claims data, Comparison between premium and claim and financial metrics for informed decision-making.

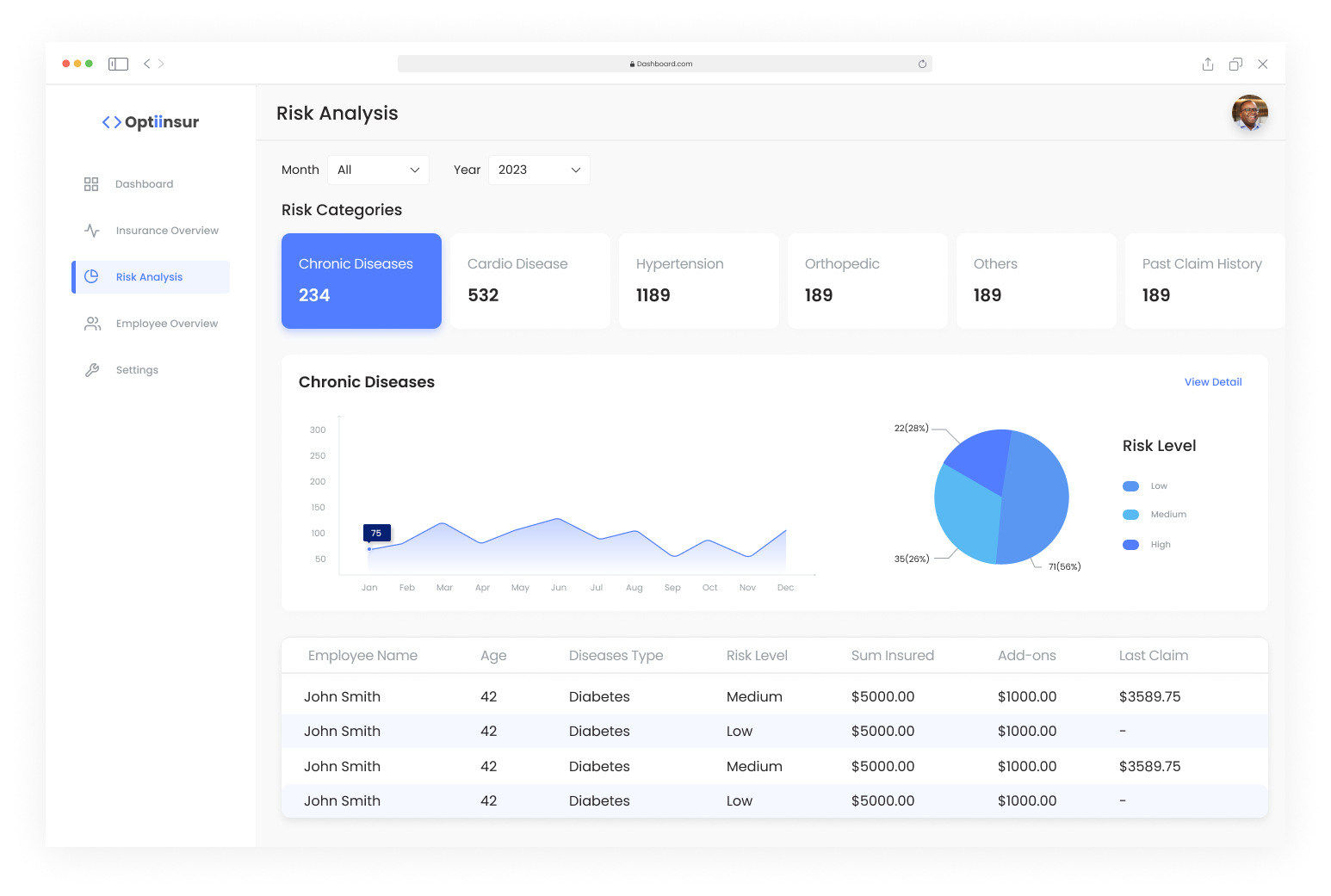

Risk Analysis:

Utilizes predictive analytics to identify potential risks based on employee medical history data, such as high-cost claimants or chronic disease. Analyze the data, we can take report that factors that affecting the insurance rate and prepare cost-saving measures.

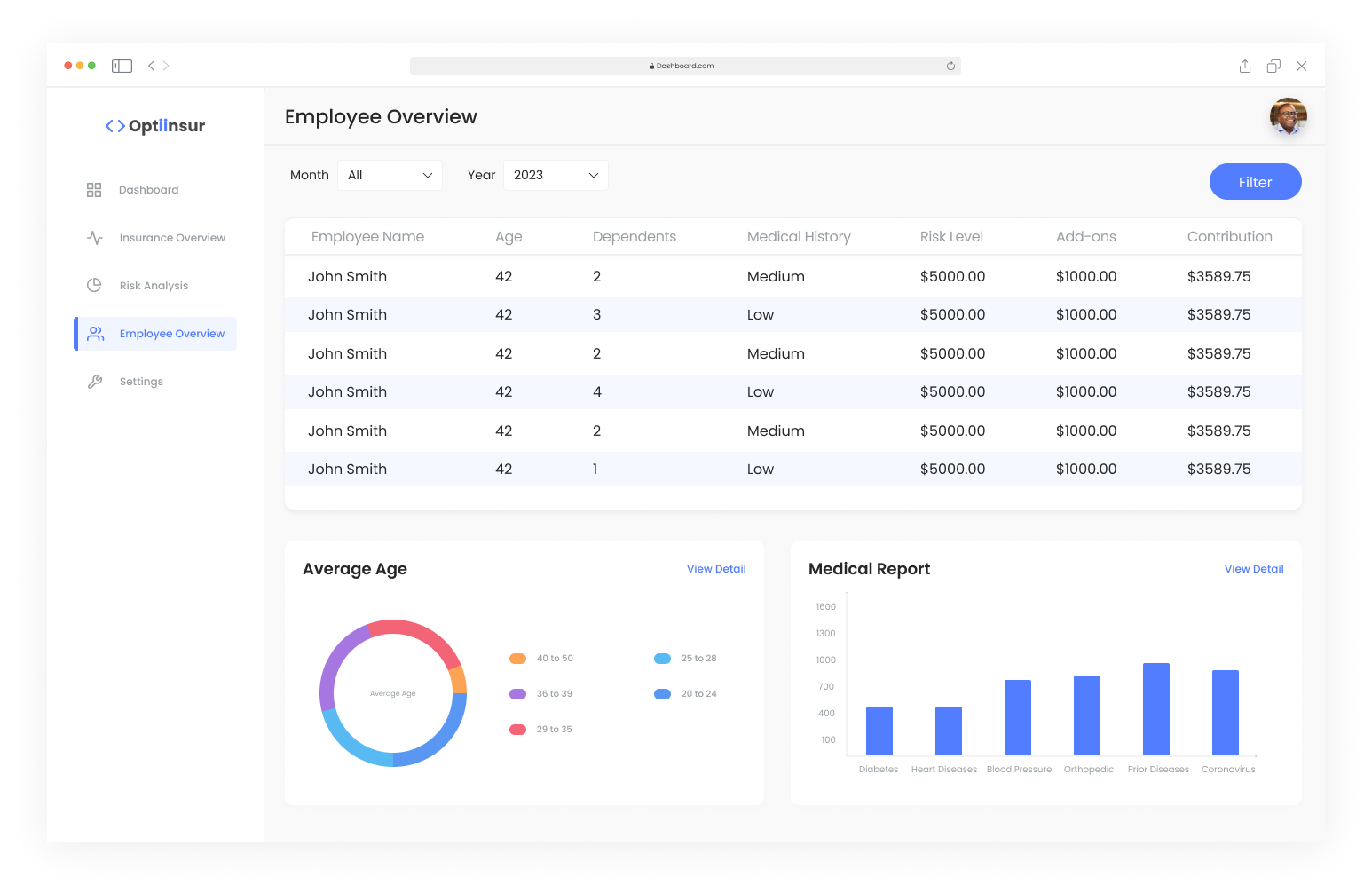

Employee Overview:

Employee and their healthy environment to make the employer productivity and produce profits. Employee plays a vital role in insurance rate or high premiums. So analyzing the employee medical data, claim details, to helps the employers to make informed decisions and cost-saving measures.

Conclusion:

By leveraging data insights and user-centered design principles, the product enables employers to effectively manage company-wide insurance, identify risks, and implement cost-saving measures. With a focus on usability and actionable insights, organizations can make informed decisions to optimize benefits for employees while controlling costs effectively.